Current Used Car Loan Rates

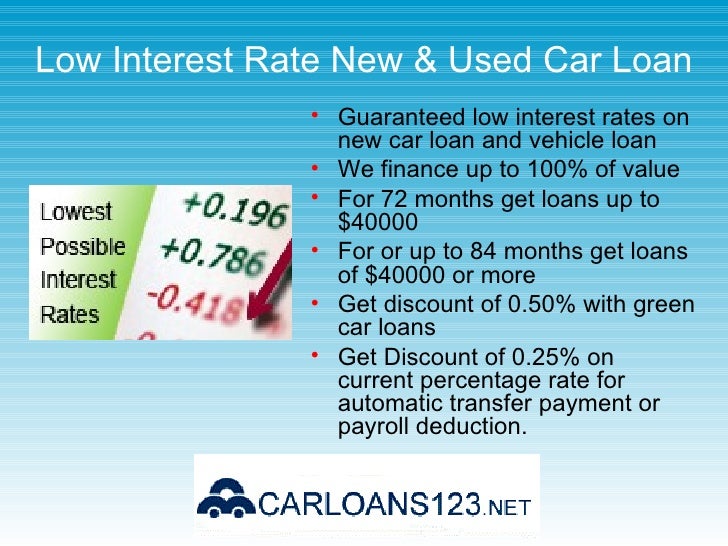

To illustrate well use some of the current rates to show you differences in interest costs for a 16000 five year car loan on a used vehicle.

Current used car loan rates. National auto loan rates. Do your research and compare companies to choose from the best car loan rates available as it could save you thousands of dollars. Car loan interest rates change frequently so its important to keep track of them. Use the filters to refine or expand your search determine current auto loan rates and apply directly for car loan financing with the institution of your choice.

However terms longer than 48 or 60 months are generally not allowed for older model used cars as the potential risk for car failure grows with age. The interest rate on a used car loan depends on your credit score. See rates for new and used car loans and find auto loan refinance rates from lenders. Well use a loan term of five years and a new car loan amount of 28800 which is the amount left to finance after a 20 down payment on the average price of a new car at 36000.

Compare auto loan rates. Your loans interest rate influences. On the other hand those with a credit score less than 660 may pay anywhere between 10 and 20. When the rate jumps to 1083 for people.

It affects both the total cost of the car and the size of your monthly payments. Consumers with a credit score over 780 only pay an average of 368. Historical auto loan rates. People with good credit will pay a similar amount.

The typical auto loan drawn for a used car is substantially less than for a new model with consumers borrowing an average of 20446 for used cars and 32480 for new. A 5 year fixed rate refinance loan for 23000 would have 60 monthly payments of 421 each at an annual percentage rate apr of 369. Suntrust used auto loans offer competitive interest rates and flexible terms. As of 4292020 the.

A 5 year fixed rate used car loan for 25000 would have 60 monthly payments of 450 each at an annual percentage rate apr of 299. Using the average interest rate for people with top notch credit 568 that works out to 4230 in interest payments. Its easy to apply and fast to get access to your funds. Cost of a 16000 five year car loan on a used vehicle.