Liability Car Insurance Coverage

If you have a car insurance policy with liability limits of 250005000025000 your insurance company will pay up to 25000 for damages to the other drivers car if a claim is filed.

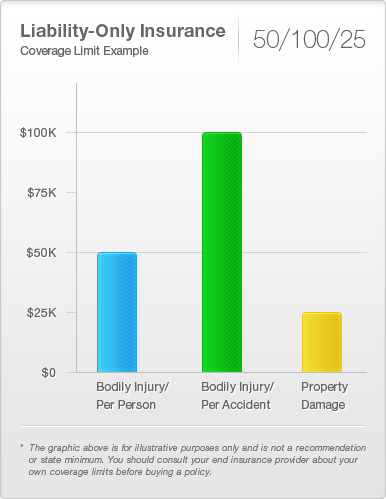

Liability car insurance coverage. This includes three types of coverage grouped together which are measured in the thousands of dollars. Coverage limits are displayed as a set of numbers with slashes between them eg 5010050. What liability car insurance covers what it doesnt. It does not however cover your own.

Even if your state doesnt require liability insurance its a good idea to have at least 500000 worth of coverage that encompasses both types of liability coverageproperty damage liability and bodily injury liability. Non owner liability car insurance will cover the drivers liability in the event of an accident meaning the insurance will pay for damages to the other driver and their. Liability car insurance is the coverage that pays to repair the damage you cause to other people and their things. No one is hurt but there is damage to both cars.

This kind of insurance provides liability coverage for people who drive but do not own a car. There are two types of liability car insurance that companies like state farm offer and each covers different items. Liability just means responsibility so liability insurance protects you. Basically liability coverage is a part of your car insurance policy and helps pay for the other drivers expenses if you cause a car accident.

Liability coverage and your car insurance policy. It does not however cover your own. Well help you find coverages that are right for you and your budget so youre not paying for those you dont need. That way youre covered for costs related to getting the other drivers car fixed property damage as well as costs related to their lost wages or medical bills.

Get the skinny on the different types of car insurance coverages from basic liability to customized parts coverage. Bodily injury liability coverage this type of coverage often referred to as bi coverage pays for the costs associated with injuries for which you are legally liable. Liability coverage only covers third parties meaning the driver and their property are not covered by liability car insurance. Coverage for injuries per person total injury coverage per accident and coverage of property damage per accident.

Wondering just how much auto insurance you actually need. There are three key numbers to look out for with liability insurance. Non owner liability car insurance. For example in a state like ohio the minimum coverage requirements are 25000 per person injured with a maximum of 50000 for people injured in an accident and 25000 property damage coverage.